Community assets claims are Washington, Ca, Idaho, Louisiana, Las vegas, The newest Mexico, Tx, Arizona, and you may Wisconsin. For many who as well as your mate stayed in a residential area assets county, you ought to always go after condition rules to determine what try community property and you will what is actually separate income. Unlike submitting an income written down, you are able to document digitally playing with Irs age-document. To learn more, realise why Do i need to File Digitally, later on. Come across Dining table step one-step one, Desk 1-dos, and you will Table step one-3 to the certain amounts. For those who perform your own company or have most other thinking-a job income, such as of babysitting or offering designs, comprehend the following guides to learn more.

Basic, statement the loss in form 4684, Part B. You may also need range from the losses on the Mode 4797 if you are if you don’t required to file you to form. To figure your deduction, include all of the casualty or thieves losses using this kind of property incorporated to the Setting 4684, traces 32 and you will 38b, otherwise Form 4797, line 18a. To learn more about casualty and you may theft losses, come across Bar. If you plus mate is filing as you and all of you’re qualified educators, the most deduction is $600. Yet not, none spouse is also subtract over $3 hundred of their qualified expenses.

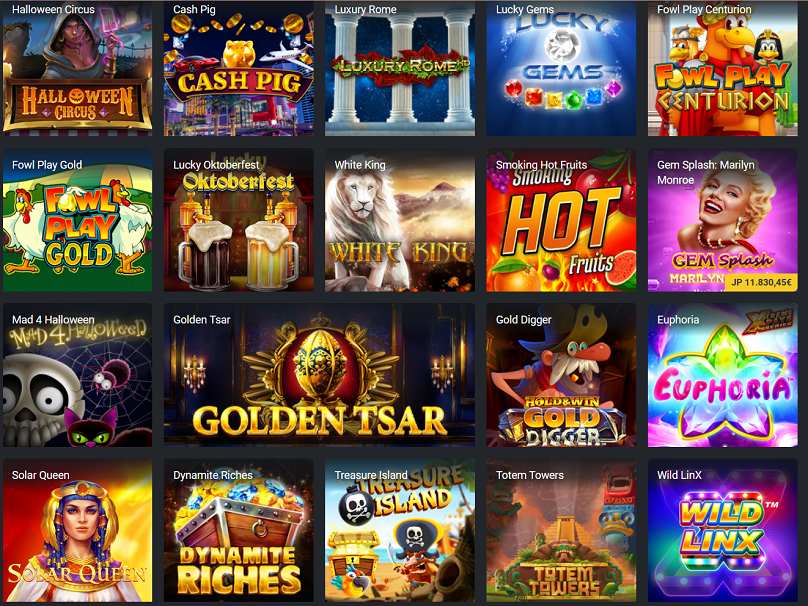

Finest Possibilities to $1 Put Gambling enterprises inside the Canada

As a whole, if your an excessive amount of contributions to own per year commonly withdrawn because of the date their come back for the seasons is born (in addition to extensions), you are susceptible to an excellent 6% taxation. You ought to afford the six% income tax every year for the a lot of quantity one to remain in their antique IRA at the end of your own taxation seasons. The fresh income tax cannot be more than six% of your own mutual property value all IRAs since the newest stop of the income tax season. If only deductible contributions have been made to your traditional IRA (or IRAs, when you yourself have more than one), you have got zero base on your own IRA.

What is actually 7 numbers within the currency?

Range from the federal income tax withheld (while the found inside https://happy-gambler.com/7jackpots-casino/ package dos from Form W-2) to your Mode 1040 otherwise 1040-SR, range 25a. Taxpayer A and you may Taxpayer B recorded a combined return to own 2024 proving nonexempt income from $48,five-hundred and you may tax of $5,359. Of your $forty eight,five-hundred nonexempt income, $40,100 try Taxpayer A good’s plus the people is actually Taxpayer B’s.

Their game lobbies machine various classes, their offers give many perks, as well as their cashiers listing of many Canada-tailored fee procedures. When you take advantage of a knowledgeable $step 1 deposit gambling establishment bonuses online, you get a good combination of lower-risk and you can high-potential perks. Some of the most well-known websites around the world help people get in on the real money step with common video game from the so it top. As the games selection for a knowledgeable $1 bonus casinos will be simply for harbors, you’ve kept the ability to turn small bets on the significant profits without having to break the bank in the process.

Specific Pupils Under Many years 19 or Full-Time Pupils

I know that investigation I’m entry might possibly be utilized to include me personally to your more than-discussed services/or features and you will correspondence within the connection therewith. Investors wished to get much more centers to hold underneath the Sonus identity, however, Dawson desired audiologists to operate their particular organizations. Very traders joined to replace Dawson and sell, which meant the brand new devaluation of his stock. With $200,000 inside the yearly severance for a few years, Dawson had time for you strategize — and you can introduce an alternative organization.

A home-Associated Issues Can be’t Deduct

As the chatted about above, enjoyment expenses are generally nondeductible. But not, you can even consistently subtract fifty% of one’s cost of team meals if you (otherwise an employee) can be acquired as well as the eating otherwise drinks aren’t felt luxurious otherwise fancy. You can’t subtract expenses (along with initiation charges) to have membership in every bar arranged to have company, satisfaction, athletics, and other public objectives. If you have one to bills complete with the expense from enjoyment or other services (such lodging or transportation), you must spend some one debts amongst the price of entertainment and you may the price of most other functions. You’ll want a fair reason for making it allocation. Such, you ought to spend some your expenditures if a resorts boasts entertainment in the the sofa on the same bill along with your room fees.

For instance, a wagering element 20x for the an excellent $a hundred incentive setting you ought to wager at the least $2000 just before withdrawing anything you win. The new players is invited that have a plus as high as C$480, in addition to 80 100 percent free spins for $step one on the Super Money Wheel jackpot position. Professionals have to bet its first couple of put incentives 2 hundred times, while some other promotions features a betting element 30x. Gamblizard is actually an affiliate marketer system you to connects participants with best Canadian gambling enterprise sites to experience the real deal currency online.

Its also wise to discovered duplicates to help you document along with your condition and you will local output. You can’t have of one’s matter you credited to your projected taxation refunded to you if you do not document their taxation get back to possess next year. When you build a projected income tax fee, alterations in your earnings, alterations, write-offs, or credit could make it necessary for one refigure your estimated taxation. Afford the unpaid balance of the amended projected taxation from the next commission deadline pursuing the alter or in installment payments from the one date and also the payment dates to the kept commission attacks.

For more information, comprehend the Tips to own Function 1040 or Pub. The fresh deduction for county and you may local taxes is bound to help you $ten,100 ($5,100000 when the married filing partnered separately). Condition and you will local taxes would be the taxation which you tend to be for the Plan An excellent (Function 1040), outlines 5a, 5b, and you can 5c. Were taxes enforced because of the a good You.S. area together with your condition and you will local taxes to the Schedule A good (Mode 1040), contours 5a, 5b, and you can 5c. Yet not, never are any You.S. territory taxes your repaid that are allocable so you can omitted earnings.